Nonprofit Statement of Activities Explained MIP Fund Accounting

Contents:

They could be more specific, seeing that they’re an elaboration of the main mission statement. Maybe it would be helpful to understand better what it means to “improve lives”, but even without this, this nonprofit mission statement is solid. Mission and vision statements capture the essence of your nonprofit organization. The statement of activities can also help you assess your organization’s ability to service debt. By understanding where your money is coming from and going, you can make informed decisions about future expenditures.

Governor donates remaining inaugural funds to nonprofits – Spectrum News

Governor donates remaining inaugural funds to nonprofits.

Posted: Wed, 19 Apr 2023 14:52:00 GMT [source]

The views, thoughts, and opinions expressed in this text belong solely to the author and do not necessarily reflect Foundant’s stance on this topic. If you have questions or comments, please reach out to our team. Have you ever looked at your personal finance history and thought to yourself, “How did I end up spending that much money?

Why the Nonprofit Statement of Activities is Important

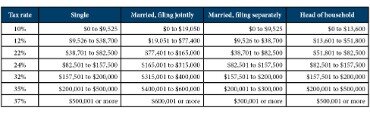

They do need to show how they are using their revenues and expenses to achieve their mission. Just because your nonprofit qualifies as tax-exempt under Section 501 doesn’t mean that all of your donors’ contributions qualify as charitable deductions. And it doesn’t mean that all of the activities your nonprofit spends money on aren’t taxable. Tax-exempt nonprofit employees are still subject to employment taxes, and your nonprofit could still be subject to sales, real estate and other taxes depending on which state it’s based in.

In this article, we’ll explain more about each financial statement, why and when nonprofits need financial statements and share examples of how organizations have used them in their annual reports. The Foundation determined that it could fund its current operating budget for the upcoming year by increasing donations from individuals and businesses. After reviewing its current expenses the Foundation determined that it could save $2,000 per month by canceling its health insurance policy for staff members. These changes would free up additional funds that could be used to support additional programs or services offered by the Foundation.

Practical Strategies for Funding Your Nonprofit’s Operating Reserves

For-profit accounting departments have a standard set of reports and statements they run to analyze their finances. Nonprofits have essentially parallel reports, but because their accounting is different, the reports differ slightly as well. Your nonprofit Income Statement shows the year-over-year income and spending trends. And how those expenses relate to the work of carrying out your mission. Typically includes “overhead costs,” including operational expenses that don’t specifically relate to executing your mission or fundraising.

Fees from rendering services, donor restricted contributions, gains & losses on investments, member dues, program fees and fundraising events. Revenues should be reported on a gross basis, but investments can be reported on a net basis. Nonprofits might also receive money from the local and federal government.

Talk to the accounting experts at Jitasa to gain a better understanding of your nonprofit statement of activities. You should look at your Statement of Activities every month and compare to previous periods. Identify trends and changes in sources of revenue, expenses, and changes to net assets. To learn more about exactly which taxes your tax-exempt nonprofit might still be on the hook for, consult IRS Publication 557, or better yet, consult with a nonprofit tax specialist. They’ll have experience helping organizations like yours minimize their tax bill and make sure you aren’t breaking any tax code rules.

Do nonprofits have a profit and loss statement?

Use photos and videos to tell your viewers the story of your nonprofit and add color to your mission statement. Don’t forget that a great mission statement encapsulates whyyour nonprofit exists, whomit serves, and howit serves them. Furthermore, “… and related programs” could be removed from the mission statement without much consequence.

- Most organizations exempt from income tax under section 501 are still required to file Form 990 , which discloses your nonprofit’s revenues, expenses and changes to net assets to the public.

- Nonprofits and associations use Statement of Activities Reports to give executives and department heads an easy to read monthly financial review.

- Double checking that the numbers are correct, interpreting the statement, and coming up with the next actions that your organization should take based on the analysis of the statement.

- This calculation shows your organization’s liquidity, allowing you to evaluate the risk your nonprofit can take.

This guide will explain what a Statement of Activities is and the key components in it. Your nonprofit statement of financial position is another key document for your cause. Nonprofits receive revenue from a number of different sources, all of which are essential to helping the organization pursue its mission. The majority of this revenue will be recorded as gross in your statement of activities.

Since many of your expenses will cover salary, insurance, rent, utilities, events, technology, etc., you may find that your restricted funds are higher than unrestricted ones. Your organization must also list expenses on your Statement of Activities report. You should split your expenses by programs, administrative, and fundraising costs. All revenue sections from your organization must also be split between unrestricted and restricted funds. Reading a nonprofit cash flow statement does not need to be overly complex.

encumbrance accounting services, management expenses, budgeting, financial and administrative fees. Expenses should be reported as major classes of program services and supporting activities. Since their mission isn’t to operate for profit, they don’t need to show a profit statement.

Start reconciling your bank accounts

Upon reading this mission statement we understand the core work of the Caitlyn Jenner Foundation, who they serve, and what they’re hoping to accomplish. MISSION also includes a tagline and a hashtag in its mission statement section. We haven’t seen much of this in the nonprofit sector, and we’re wondering if it could prove to be a best practice for inviting more engagement. Code for America works shoulder to shoulder with community organizations and government to build digital tools and services, change policies, and improve programs .

The reports and statements generated for nonprofit finances are geared toward ensuring the organization stays accountable to its donors and constituents. All of the organization’s departments should have a general understanding of these reports so they can better work together to help the organization succeed. For example, a nonprofit is likely to have a separate general ledger account for each of its bank accounts. It may also have 50 general ledger accounts for each of its major programs, plus many accounts under its fundraising and management and general expense categories. MIP is today’s leading accounting software for nonprofits and government organizations across the nation.

We especially appreciate this since nonprofit mission statements can sometimes sound “too cold” or “professional”. If you’re looking for inspiration, here are 22 examples of different nonprofits and their mission statements. Sometimes, nonprofits make their mission statements complex, but when it comes to mission statements there’s a lot of truth in that simplicity is the ultimate sophistication. Restricted Revenue includes any donations which have donor-placed restrictions on how or when the money can be spent, while Unrestricted Revenue includes any money which can be used for any purpose.

As you can see, the report is divided into the revenue and expenses along the vertical axis. Horizontally, the revenue and expenses are further categorized by restrictions placed on the funds. At the bottom of the report, there’s a section dedicated to the net assets of the organization.

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. Donated Materials – value of materials that have been donated to your nonprofit.

If that is not clear, then the expenses should be reported in the period in which they are used up. If there is uncertainty as to when an expense is matched or is used up, the amount spent should be reported as an expense in the current period. The statement of activities will also influence Report 990 generation when it comes time for tax season. The basis of Form 990 is the statement of activities and a statement of functional expense. Your nonprofit works to accomplish its mission, and when it comes to communicating that to donors and external stakeholders, no document is as helpful as a statement of activities. Donorbox is an affordable and simple-to-use online fundraising tool with powerful fundraising features such as Recurring Donations, Crowdfunding, Peer-to-Peer, Events, Memberships, and more.

To learn more about nonprofit accounting check out our nonprofit accounting standards page. The revenues are broken down further into temporarily restricted, permanently restricted and unrestricted. The IRS provides this handy questionnaire to help you figure out exactly which parts of the tax code apply to your organization, and which form you’ll use to apply for tax-exempt status. For the most part, nonprofits can apply to the IRS to become exempt from federal taxes under Section 501.

The nonprofit statement of cash flows is designed to help nonprofits recognize how cash moves in and out of the organization. You’ll not only gain a better understanding of how much money flows into your organization on a monthly basis but also of how much your nonprofit spends monthly. This is simply the calculation of your expenses subtracted from your organization’s revenue. Be sure to pay attention to the net assets that omit donor-restricted funds, as this is the most liquid part of your budget.

Expenses are reported in categories that identify specific functional areas, such as mission based programs, and support services including management and general and fundraising. The first step in reading a Statement of Activities is to understand its purpose.A Statement of Activities shows whether an organization made a profit or a loss during a period of time. It is a financial snapshot that can be used to track the organization’s financial progress. A Statement of Activities, also called a Profit & Loss Statement, is a financial report that shows how much a nonprofit organization earned or spent over a period of time, typically one year. The statement can be used to track the organization’s progress and make sure it is meeting its financial goals. Finally, one of the categories often listed as revenue on your statement of activities is your net assets released from restriction.

Nonprofit Open Buffalo proposes the creation of a 10-acre Ecology Center to be developed in East Buffalo – WKBW 7 News Buffalo

Nonprofit Open Buffalo proposes the creation of a 10-acre Ecology Center to be developed in East Buffalo.

Posted: Thu, 20 Apr 2023 19:47:00 GMT [source]

According to Jitasa’s statement of activities guide, the cherry on top of this report is its information is parallel to the information you need to provide on your annual Form 990. It breaks down your expenses into your program, administrative, and fundraising expenses—the same breakdown required on your annual tax forms. Nonprofit recordkeeping can get a bit challenging, so it is worth noting that accounting software exists to help nonprofits record transactions efficiently. The accounting software will also allow for reports of revenues and expenses by function , by the nature or type of expense (salaries, electricity, rent, depreciation, etc.), and/or by grant. As we mentioned earlier, many nonprofits use these financial statements in their annual reports to show transparency and build trust in their organization.

- Be sure to pay attention to the net assets that omit donor-restricted funds, as this is the most liquid part of your budget.

- You’ll not only gain a better understanding of how much money flows into your organization on a monthly basis but also of how much your nonprofit spends monthly.

- And that treasurer needs certain tools to do their job properly.

For instance, associations require members to pay fees to receive the benefits offered through the organization. We can help you modernize and optimize your accounting systems while also taking the time-sucking bookkeeping tasks off of your hands. And be the trusted financial partner you can turn to for answers to your questions and expert financial advice. The most significant source of revenue for most nonprofits is contributions received. Once your vendor signs it, it’s a binding contract that tells you exactly how much you ordered from your supplier, how much you paid, and when the supplier agreed to deliver your order.

From donor-imposed restrictions on funds to strict grant requirements, there are many details that nonprofits need to keep in mind before making purchasing decisions. The following table compares the main financial statements of a nonprofit organization with those of a for-profit corporation. These statements also help financial leaders show where funding is going, and if your organization’s current programs will have long-term fiscal stability. Through a statement of activities, leadership can determine what programs are working, and where to invest future resources. Nonprofits must file financial statements with the IRS to follow compliance laws, which is not the only reason they should include these activities. Save the Children’s annual report clearly states that an independent source audited their financial statements .

The idea is to give an overall picture of the nonprofit at a specific time. Nonprofits must file 4 statements every year to comply with IRS rules. Most nonprofits use these statements in their annual or impact reports. Sharing financial statements with donors is one of the best ways to ensure transparency and build trust.

After examining their statement of activities, they can determine which fund they need to allocate more money too in order to achieve their goals for the year. Statement of Activities is part of your nonprofit’s accounting requirements and is often included in its annual report or audited financial report. If you’re starting a new nonprofit, a statement of activities is one of the 4 financial reports you must file. A Statement of Activities includes revenue and expenses during a nonprofit’s reporting period and gives an overview of the changes to an organization’s net assets during that time. In-kind donations are often made to nonprofit organizations in support of their missions. While these may be more complex to record in your financial systems, it’s still important to recognize these gifts in your financial statements.

No Comments